Your balance tells you what you have. Not what’s safe to spend.

You pause before spending – not because you can’t afford it, but because you’re not sure if it’ll throw things off.

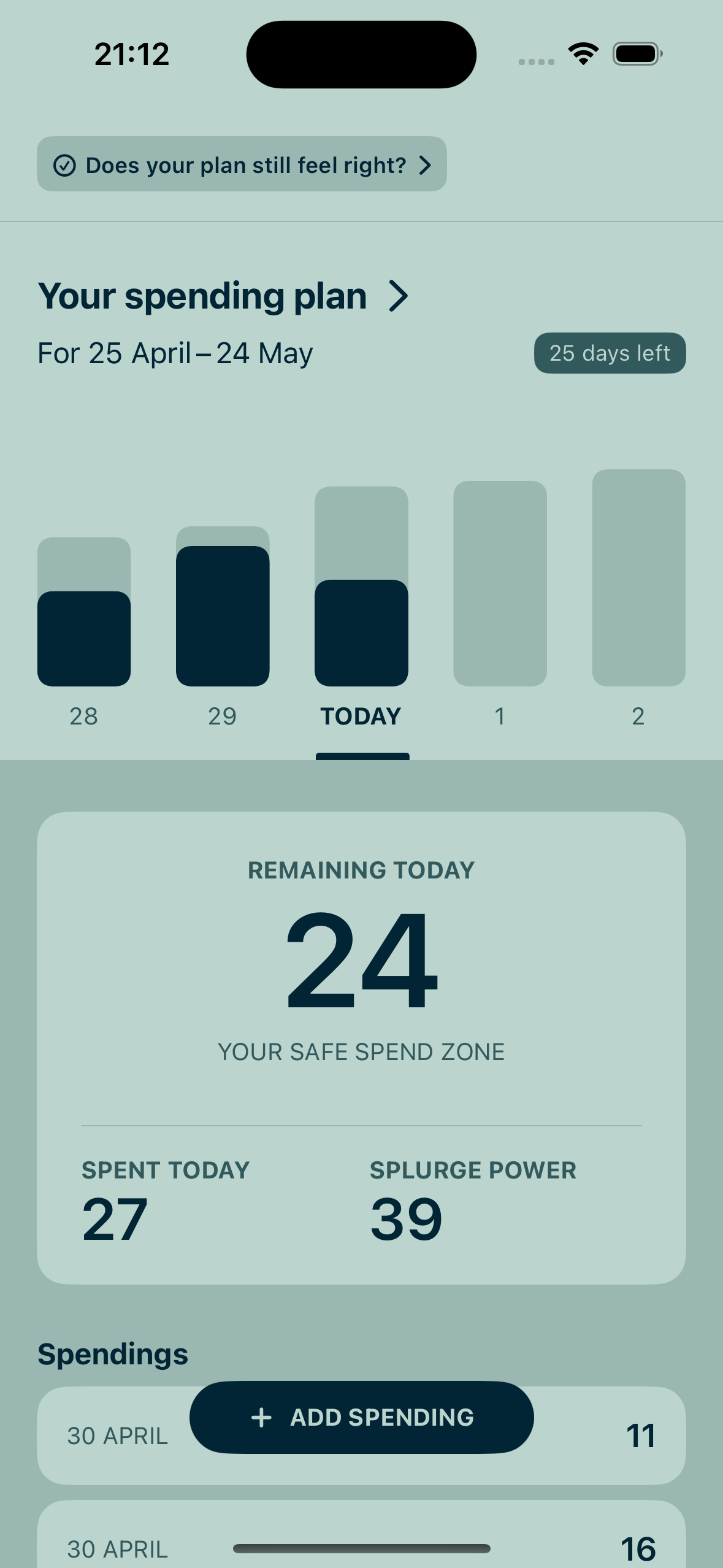

Lång shows you what’s safe to spend.

Get it on the App Store

45-day free trial. Your data stays on your device.